The smart Trick of Estate Planning Attorney That Nobody is Talking About

Estate Planning Attorney Fundamentals Explained

Table of Contents7 Simple Techniques For Estate Planning AttorneyFacts About Estate Planning Attorney UncoveredFascination About Estate Planning AttorneyHow Estate Planning Attorney can Save You Time, Stress, and Money.Little Known Facts About Estate Planning Attorney.

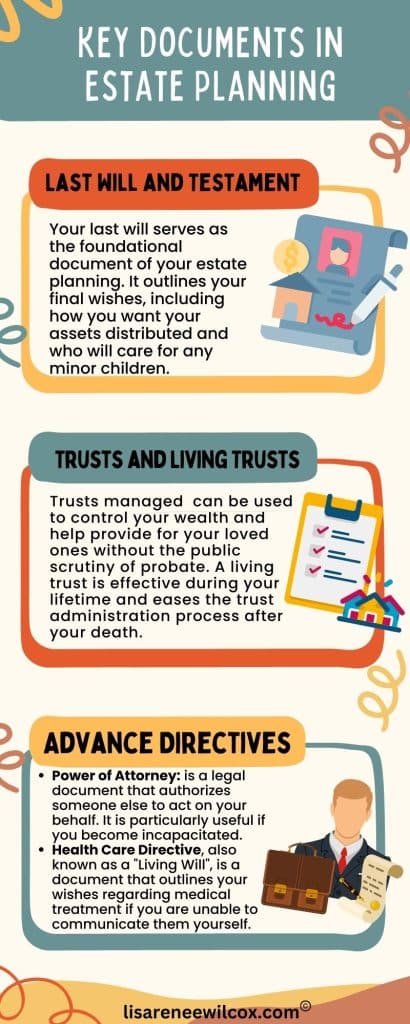

Dealing with end-of-life decisions and securing family wealth is a challenging experience for all. In these hard times, estate preparation lawyers help individuals prepare for the circulation of their estate and develop a will, trust fund, and power of lawyer. Estate Planning Attorney. These attorneys, also described as estate regulation lawyers or probate attorneys are licensed, experienced professionals with an in-depth understanding of the government and state laws that put on how estates are inventoried, valued, spread, and tired after death

The intent of estate preparation is to effectively prepare for the future while you're sound and capable. An effectively ready estate strategy sets out your last desires specifically as you desire them, in one of the most tax-advantageous way, to prevent any type of concerns, mistaken beliefs, misunderstandings, or disputes after fatality. Estate planning is a specialization in the legal occupation.

The smart Trick of Estate Planning Attorney That Nobody is Discussing

These lawyers have an extensive understanding of the state and federal laws associated with wills and depends on and the probate procedure. The tasks and obligations of the estate lawyer might consist of counseling customers and preparing lawful records for living wills, living counts on, estate strategies, and inheritance tax. If required, an estate planning lawyer may take part in litigation in court of probate in behalf of their clients.

According to the Bureau of Labor Data, the employment of lawyers is expected to grow 9% in between 2020 and 2030. Regarding 46,000 openings for lawyers are projected annually, generally, over the years. The course to becoming an estate preparation attorney is comparable to other method locations. To get involved in law institution, you must have an undergraduate level and a high GPA.

When possible, consider chances to acquire real-world work experience with mentorships or internships connected to estate planning. Doing so will offer you the skills and experience to earn admittance into legislation school and network with others. The Legislation Institution Admissions Examination, or LSAT, is an essential component of relating to regulation institution.

It's vital to prepare for the LSAT. The majority of regulation pupils use for regulation college throughout the autumn semester of the final year of their undergraduate studies.

The 8-Minute Rule for Estate Planning Attorney

Usually, the annual income for an estate attorney in the united state is $97,498. Estate Planning Attorney. On the luxury, an estate planning attorney's wage may be $153,000, according to ZipRecruiter. The price quotes from Glassdoor are similar. Estate intending attorneys can work at large or mid-sized law practice or branch off on their own with a solo technique.

This code associates with the limitations and rules troubled wills, trusts, and various other legal records relevant to estate planning. The Attire Probate Code can vary by state, however these legislations control different elements of estate preparation and probates, such as the production of the trust or the lawful legitimacy of wills.

Are you unsure browse this site concerning what career to pursue? It is a complicated question, and there is no simple solution. Nevertheless, you can make some factors to consider to help make the decision less complicated. First, rest down and list things you are excellent at. What are your toughness? What do you delight in doing? When you have a listing, you can tighten down your choices.

It involves choosing how your belongings will certainly be dispersed and that will certainly manage your experiences if you can no more do so yourself. Estate planning is an essential part of monetary planning and ought to be made with the assistance of a qualified try this website professional. There are numerous variables to take into consideration when estate preparation, including your age, health, financial situation, and family members circumstance.

Estate Planning Attorney - An Overview

If you are young and have couple of belongings, you might not require to do much estate preparation. However, if you are older and have better, you must take into consideration distributing your properties amongst your successors. Wellness: It is a vital element to think about when estate preparation. If you are in health, you might not require to do much estate planning.

If you are married, you have to consider just how your assets will certainly be dispersed in between your partner and your successors. It aims to make certain that your possessions are dispersed the way you desire them to be after you die. It includes taking into consideration any kind of taxes that may need to be paid on your estate.

The 15-Second Trick For Estate Planning Attorney

The attorney likewise assists the individuals and families create a will. A will certainly is a lawful file mentioning exactly how individuals and families desire their assets to be distributed after death. The attorney also aids the people and households with their depends on. A depend on is a legal record permitting individuals and households to transfer their assets to their beneficiaries without probate.